SOME SUGGESTIONS WHEN INVESTING IN PROPERTY IN MAURITIUS : Buying to get a rental return

SOME SUGGESTIONS WHEN INVESTING IN PROPERTY IN MAURITIUS IN ORDER TO GET A RENTAL RETURN :

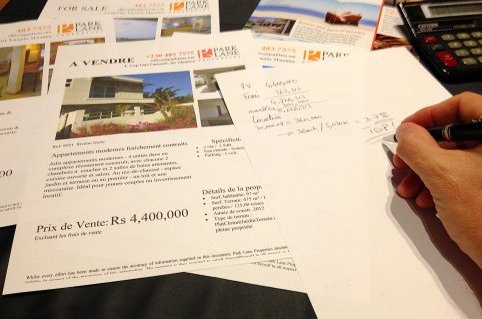

The first thing to do is to calculate what the RENTAL RETURN would be.

The easiest calculation is the GROSS rental return, which does not take into account the annual taxes payable for the property, the income tax imposed on the rental profit (only 15% tax in Mauritius on the net profit after deductions of the expenses and costs paid on the property during the income tax year) and the costs you will need to pay for the ’upkeep’ of the property.

This figure will however give you a good idea whether or not the investment will give you an acceptable return, i.e. at least equal if not higher to a savings account at the bank.

How do we calculate this? It’s easy, just follow the example below :

> Selling price of property : Rs 4,400,000

> Buying costs in Mauritius (Agency & notary fess as well as Government transfer taxes) : Rs 362,313

> Furniture : Approx. Rs 300,000 (if applicable)

Total investment : Rs 5,030,000 approx.

Monthly rental estimated (as per the advise of the estate agent) : Rs30,000 x 12 months = Rs360,000

Gross rental return : Rs 360,000 / Rs 5,030,000 = 7.1%….This would be an excellent return!

Contact Park Lane Properties today for your property search in Mauritius !

Partager